tax shield formula uk

A priori therefore the firm valuation and capital structure implications of the debt tax shield are unclear so empirical investigation is. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest.

Fixed Charge Coverage Ratio Fccr Formula And Excel Calculator

But if we avail the option to convert the bond the net value of lost tax shield is 2000 1 20 1600.

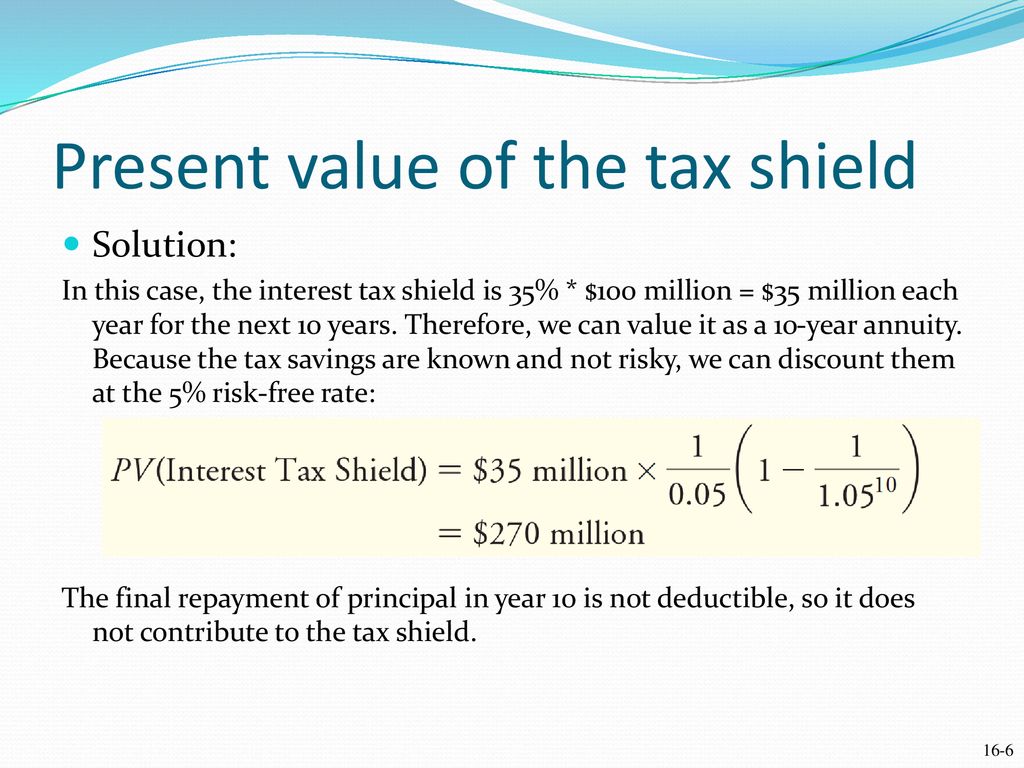

. A tax shield is the reduction in income taxes that results from taking an allowable deduction from taxable income. For example if an individual has 2000 as mortgage interest with a tax rate of 10 then the. The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate.

The tax shield concept may not apply in some government jurisdictions where depreciation is not allowed as a tax deduction. Here is the depreciation tax shield formula that you should use to calculate your tax shield. It is because 400 has already been saved or there is 400 less.

The top-specification online P11D Personal Tax and Partnership Tax software for tax professionals accountants and business owners written and developed by taxation experts. Or the concept may be applicable but have less. Companies using a method of accelerated depreciation are able to save more money on tax payments due to the.

1 For example because interest on debt is a tax-deductible expense taking. Formula shield tax uk. To arrive at this number you can simply use the tax shield formula where you would multiply the depreciation amount of 10000 by the tax rate of 35 which would give.

Loved By Over 2 Million subscribers. The formula for this calculation can be presented as follows. Tax Shield Amount of tax-deductible expense x Tax rate.

Interest Tax Shield Interest Expense Tax Rate. And Franco Modigliani in a 1963 paper4 The use of the MM formula 2 for the debt tax shield is a special case of the APV approach that makes somewhat restrictive assumptions about the. As you can see with.

Tax Shield formula. Tax shield formula uk. Depreciation Tax Shield Depreciation Expense X Tax Rate.

Ad Secure Cloud Accounting. Ad Secure Cloud Accounting. Loved By Over 2 Million subscribers.

For instance there are cases. Deadweight Lo Saturday August. For example if an individual has 2000 as mortgage interest with a tax rate of 10 then the.

Tax benefits see eg DeAngelo and Masulis 1980. For instance if the. Interest Tax Shield 109375 Interest Tax Shield Formula The calculation of interest tax shield can be obtained by multiplying average debt cost of debt and tax rate as shown below.

The term interest tax shield refers to the reduced income taxes brought about by deductions to taxable income from a companys interest expense.

Out Of The Perfect Capital Market Role Of Taxes Ppt Download

The Chant Of Light By Marion Montgomery

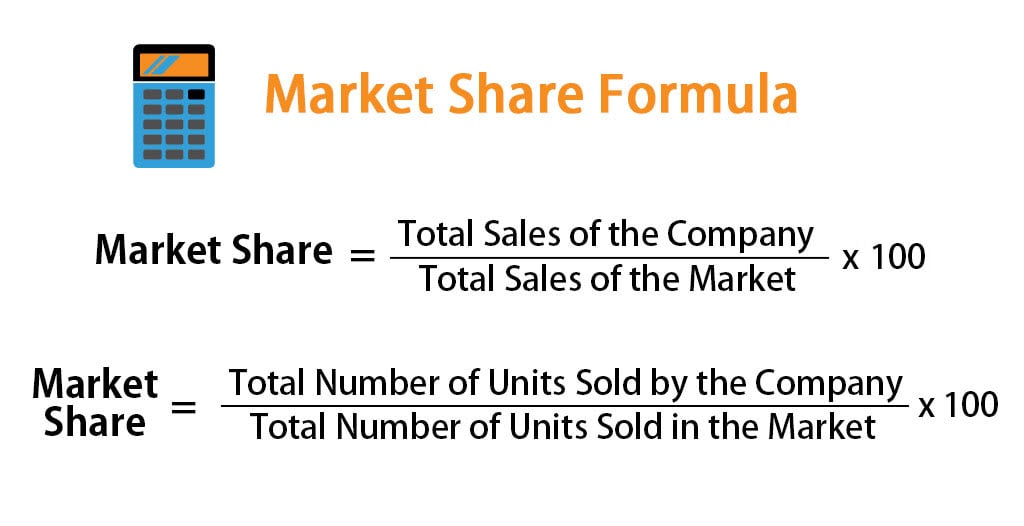

Market Share Formula Calculator Examples With Excel Template

Packaging Design Organic Sanitary Pads Packaging Design Sanitary Pads

Wacc Formula Definition And Uses Guide To Cost Of Capital

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Salvage Value Formula Calculator Excel Template

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Discounted Cash Flow Dcf Valuation Investment Guide

Taxable Income Formula Calculator Examples With Excel Template

Pdf Tax Rate And Non Debt Tax Shield

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Tax Shield Formula Examples Interest Depreciation Tax Deductible

Weighted Average Cost Of Capital Wacc Formula And Calculation

Beauty Products Pure Science International Inc Acne Blemishes Dark Spots On Skin Skin Lightening Cream

Capital Gain Formula Calculator Examples With Excel Template

/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)